Welcome to our PSD Confirmation Service

In order to help employers identify the proper Political Subdivision (PSD) codes and tax rates to be withheld from their employees under ACT 32 taxes, we have developed a program that allows you to download a file to our system and in-turn receive a report listing the proper PSD code and tax rate for each of your employees. You can utilize this information to verify that the information being submitted to you by your employees on the Certificate of Residency is accurate. This service will be provided free of charge to employers located within our taxing jurisdictions.

Employers located outside our client areas will also be able to utilize this service for a nominal fee. If you are located outside our collection areas and would like information on how to utilize this service please contact us by email using our online Client Services form.

To utilize this program and submit your file, you will need to login to our Employer E-file website. See section below to view the file layout requirements.

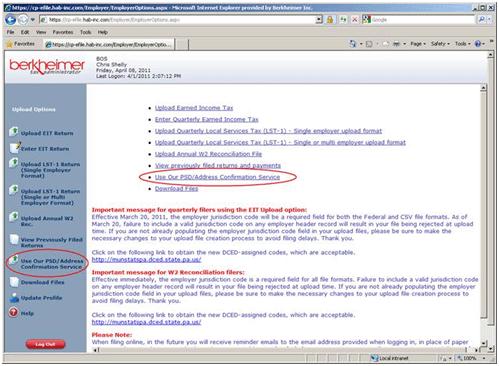

If you already have an employer account login and password, you will simply sign in using your existing information.If you do not already have an account set up, you will need to create one. Once you have logged in, you will then want to choose the following menu option: Use Our PSD/Address Confirmation Service

- At the prompt for HAB ID #, enter your account # or Fed ID #.

- Then click on Submit. Attach your file and click on Submit.

- You will receive an email indicating your file is ready to download and view within 48 hours.

Once you have received notification that your file is ready for download, simply login to the Employer E-File site and click on the “Download Files” link. Your file(s) should be listed under the section noted “Download your requested files”. Simply click on the file listed to begin downloading your file.

Click here to go to our Employer E-File Login page.

File Submission Criteria

Employers will be required to submit files in HAB standard file format

This format needs comma-separated fields. If you are using Excel to create your file and save it in .CSV format, and your file is failing with errors, please open the .CSV file using Notepad, check the file for extraneous commas or quotation marks, and compare your records to the file format and sample valid records below.

USE COMMAS AS FIELD SEPARATORS ONLY. DO NOT USE COMMAS WITHIN A DATA FIELD.

For example, do not have any embedded commas in the Employee Name or Employee Address field. Every comma is interpreted as the end of a field. Extraneous commas will cause your file to be rejected with errors that may not seem to make sense, but that actually do make sense when you take this into account.

DO NOT PLACE ANY QUOTATION MARKS IN YOUR FILE.

Quotation marks shown below are for clarity of documentation only.

EMPLOYEE INFORMATION

| Column | Field |

| A | Employee Identifier For your reference only – not used by HAB. Example: SSN, or some other Unique ID. (*) |

| B | Employee Name |

| C | Employee Address 1 (No PO Boxes) |

| D | Employee Address 2 (No PO Boxes) |

| E | Employee City |

| F | Employee State |

| G | Employee Zip Code in 1 of these formats

|

Files should be submitted in .csv format. Files will be rejected if they are not provided in the required format.

* If you do not currently have an account number with us you will still be able to utilize this service. You will need to contact our Client Services Department using our online Client Services Contact form or by phone 1-610-599-3139.

Output File:

The output file will retain the original filename. The output file format is as follows:

a. Identifier (SSN or E-ID)

b. Name

c. Address[1] (standardized version)

d. Address[2] (standardized version)

e. City (standardized version)

f. State (standardized version)

g. Zip code (standardized version)

h. PSD code (taxjur.psd-juris or zero if unknown)

i. PSD name (taxjur.name or “UNKNOWN”)

j. Current tax jurisdiction rate